He bought a mortgage house, he wanted to repay it from renting.He recalculated

The real estate market has been attracted to anyone, as evidenced by statistics, according to which almost 40 percent of all new apartments sold are bought by people for investment.Half of them to rent the apartment.And sometimes even a family house.

“Savings products for low interest do not give too much money to protect money from inflation.So people turn to reality.Today, it is no exception that parents, when they have money or reach a mortgage, and already have their own housing, buy an apartment for their children.And until the descendants grow up and become independent, they want to rent the apartment, ”says Dana Míchalová, Partners financial advisor.

Her words are also confirmed by the economist and main advisor to the Chairman of the Board of the DRFG Investment Group Martin Slaný.He adds another reason why people today seek protection and evaluation of money mainly in real estate."If you do not offer people a solid and distinct alternative in low interest rates, how to secure yourself for old age, we cannot be surprised that people will start to invest in real estate to secure them financially," he says.

This de facto says that if a high -quality state -supported pension system would work in the Czech Republic, there would be decreased those who invest in real estate to be sure of age.

The story of Jáchym

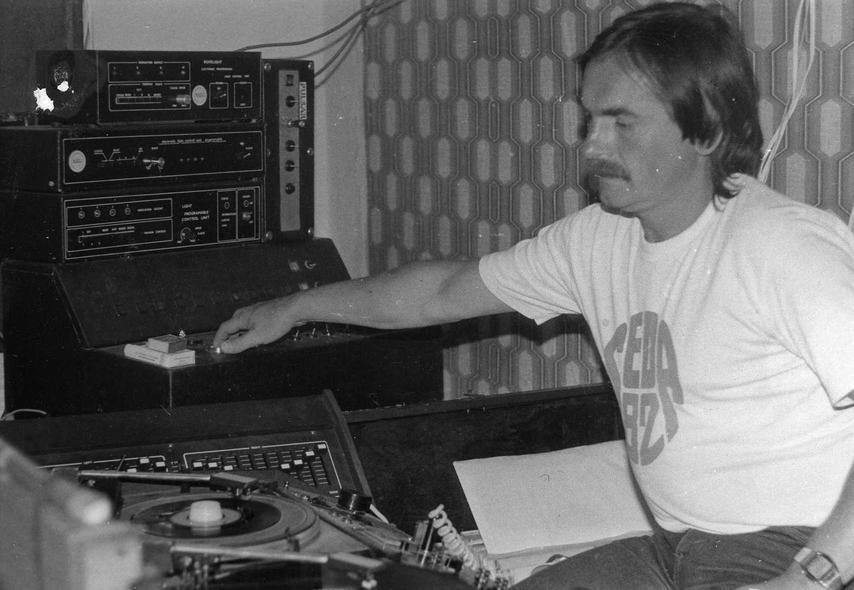

Jáchym from the Central Bohemian Region also has his experience in investing in real estate.The profession is a warehouse worker.He grew up with two brothers and his parents saved each of them to the beginning of 250 thousand crowns.Jáchym bought a small apartment for money in a nearby village and financed it with a mortgage loan that has already repaid.“I offered the opportunity to buy an older family house from the 1970s in the village.He was not maintained, but having his own house was my dream, ”he says.

He decided to buy the house, either living throughout the house and renting his small apartment.Or he rents his small apartment and half the house and tenants will pay him a mortgage.At first it seemed like an excellent idea."But I would never let go of something like that," he says after experience.

What are investments in real estate

Real estate broker Daniel Kotula claims that the most common mistake of all beginners in investing in realities is when they think it is a toy.Jáchym's case calls the risk.Already because they choose real estate to speculate in the village.

“First, those interested in buying a property he wants to rent should consider a suitable location, because the locality determines how quickly the property will have the tenant occupied.What type of people interested in rental will go for tours.What will be rented, ”explains the real estate broker.

It is also necessary to consider the value of the property in the future, because each locality in the long run changes the value at a different pace.According to him, locations are ideal, where there is very high employment and people move to work from a wide area.In such places, the demand of rental apartments is high, as well as a selection of solvent tenants.

“Those interested in investing in investment real estate should focus on smaller apartments, because the smaller the less, the better.Ideal are apartments with 1+kk layout and size up to 30 square meters.Such apartments are fastest occupied and are achieved with the highest yield.In terms of the price of the apartment and the amount of its rent, ”explains the broker.

His words are confirmed by Dana Míchalová and is also commented on the case of Jáchym.“In order to pay a rental mortgage, it will have to include the cost of purchasing land.It can be more value than the house itself, but the tenant will not be very interested.The cost of reconstruction of the house may also show as a problem.All this needs to be thoroughly calculated.Have your investment plan, accurate cost and income calculation.Know the return time of investment, determine the timetable of the necessary steps.And having a certain financial reserve when it is not so easy to rent reality, ”says Míchalová.

Jáchym buys a family house

Jáchym had none of this.Even so, the bank ran a mortgage for the acquisition of a family house.He borrowed 2.1 million crowns with a maturity of 20 years and an interest rate of 2.62 % with five years of fixation.In addition, he put his apartment into the bank to pledge the bank.

All this took him about a month, but he bought the house.The transfer of the property was completed in the spring of 2018. However, the old house after the previous owner had to completely vacate, the equipment was very neglected.At the same time, it has been shown that the property requires reconstructing heating, putting water in order and repairing fencing.And there were other problems, which in the finals meant that he could not move into the house immediately and had to postpone the lease of his small apartment.At the same time he had to move the lease of part of the house.

Two properties, double costs

With the property of the house, Jáchym was added four thousand for postal money.And not only that.He had to pay an invoice from a notary for services related to the purchase and transfer of real estate.But even the expenses did not end.He had to pay a real estate acquisition tax of four percent of the purchase price of the house, which was 84 thousand crowns.“I no longer had a financial reserve.To do this, I planned to buy building material and pay for the helpers with the modification of the house so I can start renting two rooms as soon as possible, ”he says.

Secondary purchase costs to purchase real estate: |

The situation forced him to count him.He found that his monthly mortgage loan expenses and basic monthly fees were a total of 19 251 crowns.To do this he had to give four thousand crowns a month for transport to work.Of the earned 29 thousand clean, he had 5,749 crowns for food, telephone and reconstruction of the house.“I went to the bank and borrowed 150 thousand crowns for a consumer loan.So I had another commitment to the next five years, ”he says how he solved the thing.From the loan he paid the real estate acquisition tax and used part of the money for construction work in the house.

Is not a tenant as a tenant

Despite the extreme increase in expenditure, Jáchym did not give up.After arranging a consumer loan, although his installments increased to 15 thousand crowns per month, he still prepared the house for living.He occupied his small apartment with the first tenants, and began to inhabit his family house.But he didn't enjoy peace.

The first tenant stopped paying after two months, another lasted less than six months.He had to pay water, energy and deal with complaints from neighbors for their behavior.With tenants who moved into the house after some time, he found that he did not fit his coexistence.“That led me to realize that I would not rent the house at all.And as far as the apartment is concerned, I used the services of an agency that cares for everything and only she is acting with the tenants.Although it reduces me of rental, but I do not want to solve it myself.I need to have an apartment stable, ”he explains.

He considers his situation unbearable today.He does not want to give up the house, he is going to sell his small apartment in the future so that he can easily repay his obligations and continue to reconstruct the house.

As experts see it

According to Daniel Kotula, each future investor should well calculate the return time of the investment.It is rather long -term in real estate and bears a high degree of risk of sudden fluctuations in real estate markets.This means a fall in prices both real estate and the amount of rent.

It is also important to have a well -built lease agreement.The lease contracts must follow the very detailed provisions of the Civil Code and the contractual freedom beyond the scope of the Code is very small."The most difficult error of the lease is the lease for an indefinite period, which is very difficult to terminate for the landlord," Kotula explains.

According to Dana Míchalová, the case is not unique.“Many investors in real estate ended up in his plans.Either he bought the property badly, or he could not rent it successfully and long, or he was not sufficient for money to repay the mortgage.It always ends the same.By selling assets and financial loss.And sometimes even by declaring personal bankruptcy, ”he points out.

According to Daniel Kotula, investments in real estate are business as any other.Who can do it, has a certain profit, who does not, or does not adhere to proven procedures, will lose money.“But he should not be rented by a socially based person who is willing to let someone else live at his expense.Here is the risk that he will rent the property to someone who will abuse him.Whether through a low rent or through non -payment, ”he concludes.