Advances for health and social insurance.How much do you pay in 2020?

When calculating the maximum and minimum insurance premiums for self-employed persons, the average salary is used. In order to calculate the minimum advances for 2020, we need to know the expected amount of the average salary for 2020. This is determined by Government Regulation No. 260/2019 Coll. (with effect from January 1, 2020) based on the general assessment basis (for 2018) and the conversion coefficient for its adjustment (based on statistics for the first half of 2019), which should take into account the growth of average wages.

Important data for determining advances for 2020:

The estimate of the average wage for the next year is then the result of multiplying the general assessment base and the conversion coefficient. According to the draft government regulation, the assessment basis for 2018 amounts to CZK 32,510 and the coefficient is 1.0715. The average salary for 2020 is therefore estimated at 34,835 CZK (32,510 × 1.0715 = 34,834.465, rounded up to the whole CZK to 34,835 CZK). For comparison, last year's (2019) average salary was CZK 32,699.

The amount of monthly advances depends on your gross profit in the last calendar year (2019), but you must always pay at least a minimum monthly advance when performing your main self-employment.

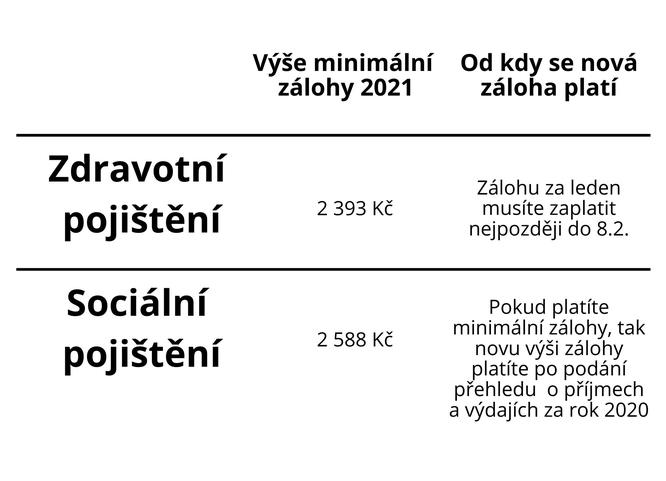

Increase of advances for social insurance

The advance for social or pension insurance is derived from the profit achieved (more precisely, the tax base) and the assessment base for the self-employed is set as one half of its twelfth (in the event that the self-employed you operate throughout the year, i.e. 12 calendar months). The insurance rate is 29.2%. If your assessment basis is lower than the specified minimum assessment basis, the minimum assessment basis applies to you and you will also pay only the minimum advance payment for the insurance premium.

Minimum advances for self-employed persons, for whom business is the main livelihood activity

We calculate the minimum advance as 29.2% of one quarter of the average salary, i.e. from the amount of CZK 8,709 (i.e. the minimum monthly assessment base), which we rounded up to whole crowns. The minimum deposit for 2020 is therefore CZK 2,544 (8,709 × 0.292 = 2,543.028, rounded up to whole crowns, i.e. 2,544).

Survey

Do you run a trade as your main activity?

If we compare this amount with the minimum advances for the year just passed 2019, i.e. the amount of CZK 2388 , we find that the minimum deposits will increase by CZK 156 (2544 − 2388) in 2020. In the previous year, the minimum deposit increased by CZK 199. This year's increase is therefore not at all dramatic given the ever-increasing average wage.

Minimum advances for the self-employed, for whom the business is a secondary livelihood activity

The annual minimum assessment basis for an activity that lasted for the entire calendar year, i.e. all 12 months, corresponds to the amount of CZK 104,508 (8709 × 12 ). If the activity did not last a whole year, the minimum assessment base is multiplied by the number of months in which the activity actually lasted.

The annual maximum assessment base, on the other hand, is set as 48 times the average wage, so it will amount to CZK 1,672,080 for the next year. If your annual income for 2020 exceeds this limit, you will not pay additional pension insurance or pay the solidarity surcharge from this amount.

The minimum monthly advance for self-employed persons who run their business as a secondary activity (for example, they run a business while working, studying, in retirement, on maternity leave or while receiving parental allowance) is calculated as 29.2% of one tenth of the average wages (minimum monthly assessment base for secondary activity), i.e. as 29.2% of the amount of CZK 3,484 (rounded up to whole CZK). For next year, a minimum deposit of CZK 1018 will apply (3484 × 0.292 = 1017.328, the deposit is also rounded up to whole crowns).

The annual minimum assessment base for a secondary activity that lasted for the entire calendar year, i.e. all 12 months, corresponds to the amount of CZK 41,808 (3484 × 12). If the activity did not last a whole year, the minimum assessment base is multiplied by the number of months in which the activity actually lasted.

Social insurance, comparison of 2019 and 2020

| Year 2019 | Year 2020 | |

|---|---|---|

| Maximum assessment base (limit for joint taxation) | CZK 1,569,552 | CZK 1,672,080 |

| Minimum annual assessment basis main activity | < td>CZK 98,100CZK 104,508 | |

| Minimum annual assessment base secondary activity | CZK 39,240 | < td>CZK 41,808|

| Minimum monthly assessment basis main activity | CZK 8,175 | CZK 8,709 |

| Minimum monthly advance main activity | 2388 CZK | 2544 CZK |

| Minimum monthly advance secondary activity< /th> | CZK 955 | CZK 1018 |

| Determining amount for secondary activity | CZK 78,478 | CZK 83,604 |

| Minimum assessment base for sick self-employed persons | CZK 6,000 | CZK 6,000 |

| Minimum sick pay | 138/126 CZK | 126 CZK |

| Monthly income of employees establishing participation in sickness and pension insurance | CZK 3000 | CZK 3000 |

Determined income for participating in sickness insurance (it as a self-employed person you may or may not have to pay), it remains CZK 3,000 per month for 2020. (In the years 2012 to 2018, the amount was CZK 2,500.) The increase then took place from January 1, 2019.

Change in the minimum sickness benefit for the self-employed

For the self-employed and foreign employees, as a result of the change in the insurance premium rate, from 1 July 2019, the minimum amount of the sickness insurance premium was reduced to CZK 126 (2.1% from the minimum assessment basis, which is CZK 6,000). The minimum premium for sickness insurance (in the period from January 1, 2019 to June 30, 2019) was CZK 138.

The lower premium rate was first reflected in the payment of insurance premiums for July 2019. This change had no effect on employees, as the employer pays the premiums for them at the new rate. However, self-employed persons and foreign employees who voluntarily pay for health insurance could reduce their monthly payments to CZK 126.

If you pay for health insurance and your maximum monthly assessment basis for premium payment is higher than CZK 6,000, a higher assessment basis was calculated from your paid insurance premium payment in the period from July 2019 than from previous payments, precisely with regard to the reduction of the insurance premium rate . If your assessment basis is only CZK 6,000 and you have not reduced your payment, you will be charged an overpayment on your health insurance premium at the beginning of 2020.

Increasing health insurance advances

The assessment basis for calculating health insurance advances is one-half of the income achieved after deducting expenses, whether actually incurred or applied as a flat rate. The health insurance rate is then 13.5%. It is multiplied by the amount of the assessment base, which cannot be lower than the minimum assessment base derived from the average monthly wage of CZK 34,835. Half of the average salary amounts to CZK 17,417.50, after rounding, CZK 17,418.

So we get the amount of the minimum deposit: 17,418 × 13.5 = 2351.43. After rounding up to whole crowns, it is 2352 CZK. The minimum deposit in 2019 was CZK 2,208. This year, the self-employed will therefore pay an additional 144 CZK. The reason for the increase in minimum deposits is the increase in the average wage. The maximum assessment base is not determined for health insurance.

Health insurance, comparison of 2019 and 2020

| Minimum deposits | Year 2019 | Year 2020 |

|---|---|---|

| Self-employed persons | 2208 CZK | 2352 CZK |

| State insured persons | 1018 CZK | 1067 CZK |

| Persons without taxable income | 1803 CZK | 1971 CZK |

You must always pay the health insurance deposit by the 8th of the following month. Attention, the new amount of the minimum deposit is paid (unlike the social security deposit) from January onwards. If you are already paying more than the minimum deposit that will apply next year, your deposit will not change until you have submitted the 2019 Self-Employed Self-Employed Income Tax Statement.

In other words, if you now pay, for example, CZK 4,148, you will pay the same amount in the first months of 2020, until you hand in the overview of income and expenses for 2019. You will pay the new amount of the monthly advance only after this handing in, and its amount will depend on your achieved gross profit for the year 2019. If you start your business, for example, from April 2020, you must pay the first advance for health insurance in the amount of CZK 2,352 on May 8, 2020. (In the first year of operating the main self-employed activity, only minimum monthly deposit.)

Advances for health insurance for a secondary activity

If you only run a business for a secondary activity (for example, you run a business during maternity or parental leave, while studying, working or you are retired), the minimum assessment basis does not apply to you. You have to pay health insurance deposits only from the second year of business, and only from the actual profit from the previous year. Employees who have a side business do not have to pay any advance payments at all, they always pay the insurance premium derived from the actual profit after submitting the income statement.

Contributions for state insured persons are also higher

The assessment basis for health insurance premiums, which the state pays for so-called state insured persons, is also increasing. It will increase from the amount of CZK 7,540 to CZK 7,903. The insurance premium will also increase from CZK 1,018 to CZK 1,067 (7,903 × 13.5% = 1,066.9).

For example, the following are considered to be state insured:

Insurance has also become more expensive for self-payers

Health insurance will also become more expensive for self-payers, due to the increase in the minimum wage. The so-called self-payers are persons without taxable income for whom the state does not pay health insurance. These are, for example, students over the age of 26 or unemployed people who are not registered at the employment office. The minimum wage increased from CZK 13,350 to CZK 14,600 this year. Therefore, the amount of insurance premium calculated from it (13.5%) will increase to CZK 1,971 from the previous CZK 1,803. You will therefore pay an additional 168 CZK. As the increase applies from January 2020, the premium payment must be increased already for January 2020, which is due no later than February 8, 2020.